4 Payment Trends Worth Watching In 2023

The way we pay and the way we buy things is continuously changing thanks to new payment technologies emerging with every passing day. While traditional payment methods aren't going anywhere anytime soon, they will have to respond to customers' desire for flexibility and convenience. In this blog, we offer some trends that we think will likely shape the way people pay for goods and services in 2023.

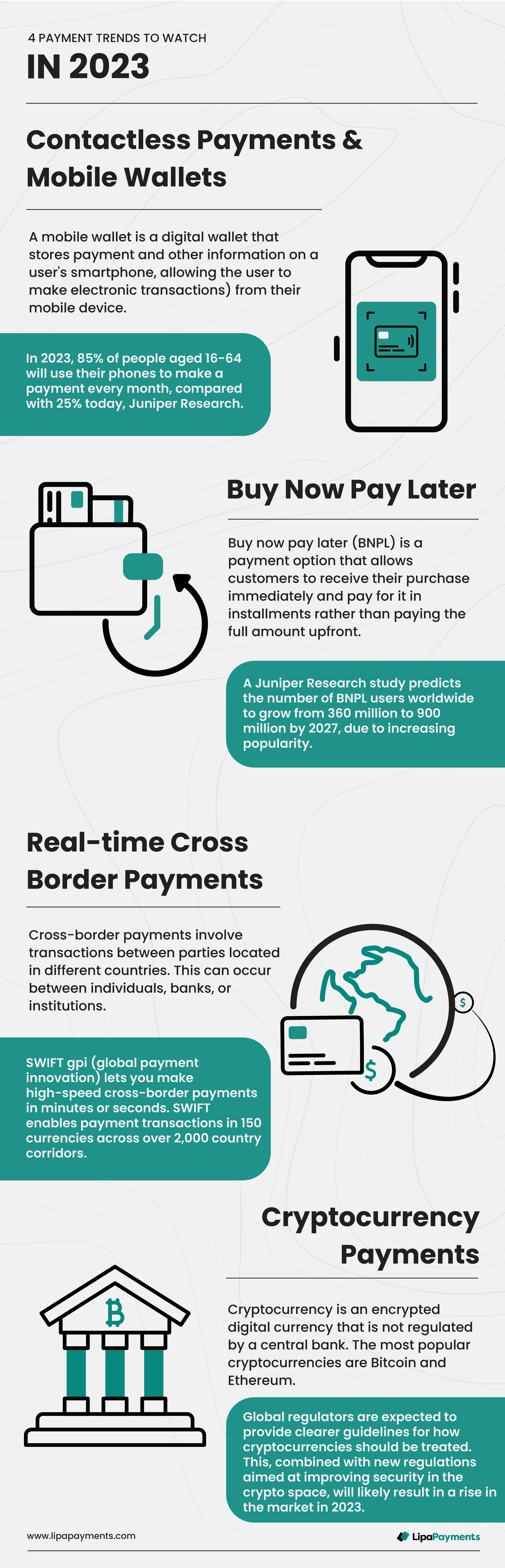

Contactless payments and mobile wallets

In 2023, it is projected that 85% of individuals aged 16-64 will make monthly payments through their mobile phones, a significant increase from the current rate of 25%. The rise in usage can be attributed to the widespread availability of NFC and contactless-enabled POS terminals, according to Juniper Research.

A mobile wallet is a digital wallet that stores payment and other information on a user's smartphone or tablet, allowing the user to make electronic transactions (such as paying bills, making purchases, and sending money) from their mobile device.The data is stored directly on the device secure element rather than in the cloud, providing enhanced security against unauthorized access. Mobile wallets can be used anywhere with cellphone signal and offer the convenience of instant payment once the app is set up. Popular mobile wallets include Samsung Pay, Google Pay, and Apple Pay.

Despite the steady growth of contactless payments, many people are still unaware of the option to make payments using their mobile phones. Convenience continues to be a driving factor in the adoption of contactless payments.

Buy Now Pay Later

Buy now pay later (BNPL) is a payment option that allows customers to receive their purchase immediately and pay for it in instalments rather than paying the full amount upfront. BNPL companies typically split the payment into equal parts, with the first instalment due at the time of checkout. The popularity of BNPL has been growing and a Juniper Research study estimates that there are currently 360 million BNPL users worldwide, with this number projected to double to 900 million by 2027. Some of the BNPL companies worth watching as they expand include Lipa Later in Kenya, PayFlex in South Africa, LazyPay in India, Klarna in Sweden, and Affirm in the US.

Real-time Cross Boarder Payments

Cross-border payments involve transactions between parties located in different countries. This can occur between individuals, banks, or institutions. As the world becomes increasingly globalized, the need for efficient and transparent cross-border payments is growing. The popularity of real-time cross-border payments has increased due to the rise of e-commerce and global trade. Driving factors include greater demand for fast and efficient payment methods, technological advancements, supportive government initiatives, increased competition among financial institutions, and growth in digital currencies.

If real-time cross-border payments continue to grow as predicted, businesses and consumers will have access to a wider range of fintech companies. This will provide more flexibility and convenience in the financial market.

SWIFT gpi (global payment innovation) instant payment service blends gpi's capabilities with real-time payment networks within countries, creating cross-border payments that are as fast and effortless as domestic ones. Participating banks using SWIFT's service can make and receive cross-border payments in near real-time and beyond typical business hours.

Cryptocurrency Payments

Cryptocurrency is an encrypted digital currency that is not regulated by a central bank. As a global currency, it enables payments free from geographic and banking restrictions.

Cryptocurrency payment gateways provide businesses with the means to accept cryptocurrency payments from customers in exchange for goods or services. The most popular cryptocurrencies are Bitcoin and Ethereum.

Cryptocurrency payments can be made through various channels like online and mobile wallets (eg. Coinbase, Luno and Valr). The increasing recognition of cryptocurrencies and the technology behind them is expected to drive their growing usage, leading to a potential surge in adoption among businesses and individuals. As the crypto sector matures, global regulators are expected to provide clearer guidelines for how cryptocurrencies should be treated. This, combined with new regulations aimed at improving security in the crypto space, will likely result in a rise in the market in 2023.

These developments showcase the rapid evolution of the concept of money. While its value might remain unchanged, the items it can purchase and who can use it is likely to be altered by 2023. The future holds exciting prospects for how we pay for things and what impact this might have.

If there are any topics you would like us to cover or if you're interested in collaborating with us, please email us at marketing@lipapayments.com.