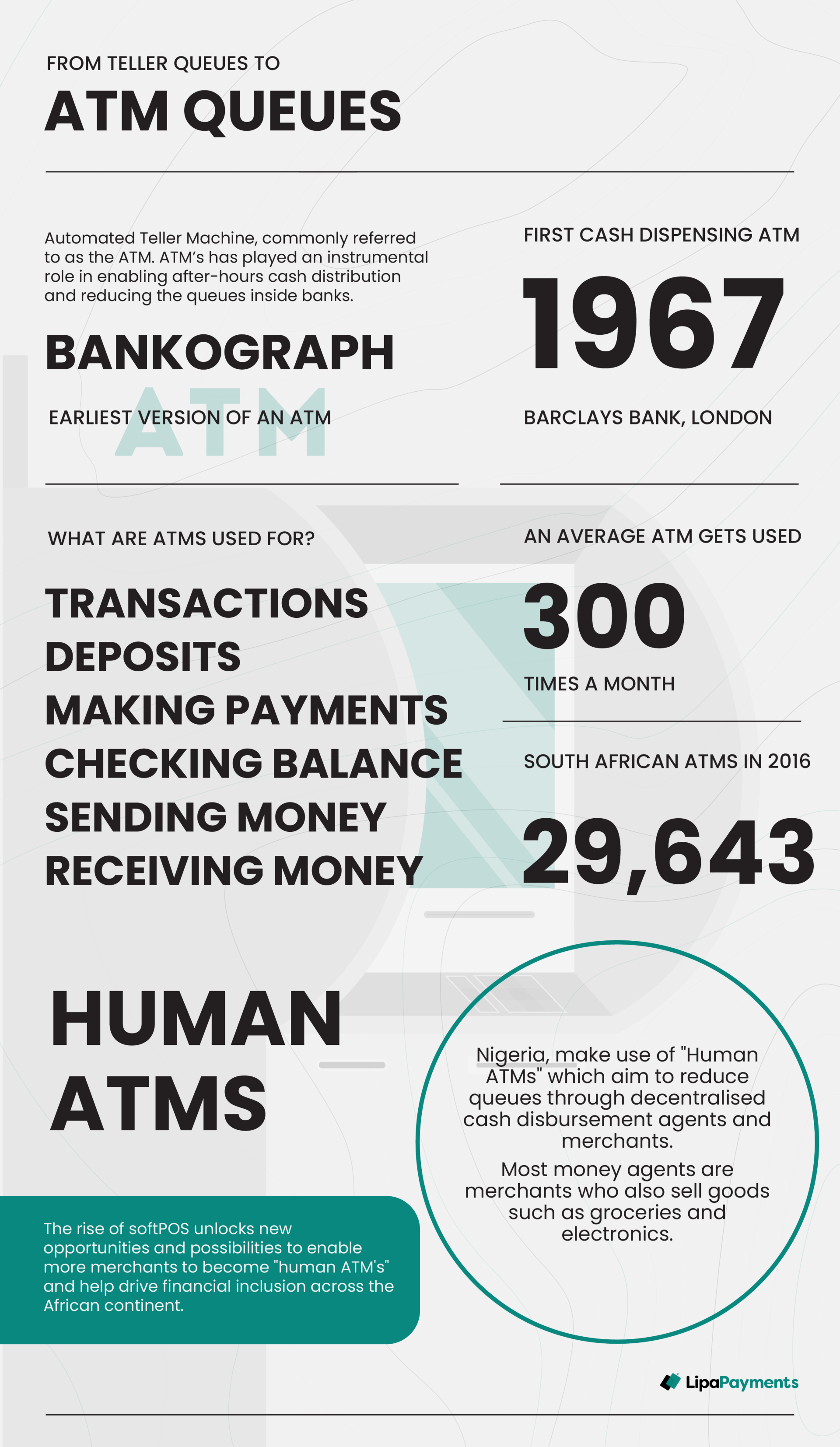

From Teller queues to ATM queues

The Automated Teller Machine, commonly referred to as the ATM, has played an instrumental role in enabling after-hours cash distribution and reducing the queues inside banks.

The earliest version of an ATM was the Bankograph, an automated deposit machine (accepting coins, notes and cheques) that did not have cash dispensing features. The first cash dispensing ATM was installed on the 27 June 1967, in Enfield Town, London, by Barclay’s Bank. South Africa had its first ATM installed in 1977 by the United Building Society (Later United Bank, now part of ABSA).

Globally, the average ATM gets used approximately 300 times a month and can be used for different types of transactions with withdrawals being the most common type of transaction. Other transaction types include deposits, making payments, checking bank balances and sending or receiving money. ATMs are available 24/7 to customers and are located in convenient locations allowing customers to have easy access to cash.

Before ATMs, all transactions required individuals to walk into a bank branch and queue for assistance from a human bank teller during office hours. This meant that people had to withdraw all the cash they required before bank tellers close for the day. ATMs also helped reduce the queues found inside bank branches as simple deposits and withdrawals could now be performed outside of the branch.

Many years later, the famous bank teller queues now stretch far beyond the doors of the bank as ATM queues continue to exist. Cash remains an important part of how many South Africans transact in their daily lives. In 2016 South Africa had more ATM’s than any other country in Africa with 29,643 ATMs.

Countries like Nigeria, make use of "Human ATMs" which aim to reduce queues through decentralised cash disbursement agents and merchants.

According to the GSMA State of the Industry Report on Mobile Money 2019: money agents have 7 times more reach than ATM's and 20 times more reach than bank branches. This provides the underserved and underbanked population more access to money and financial services. In 2020 MTN signed up more than 280,000 MoMo (MTN Mobile Money) agents in Nigeria, their biggest market. Besides offering mobile money services, most agents are merchants who sell goods such as groceries and electronics.

The rise of softPOS unlocks new opportunities and possibilities to enable more merchants to become "human ATM's" and help drive financial inclusion across the African continent.