Beating load-shedding with Lipa Payments

Every South African knows about load shedding and for many it means getting out the candles or back-up lamps and making sure our gadgets are charged, at least. That’s what more than a decade of rolling blackouts (with more to come) have taught us.

But for small business owners it’s much more than that. For those who cannot afford a generator it means lost production and sales and lots of anxiety. Many merchants have to revert to a cash-only system as point of sale devices are dependent on electricity to work. You would think that in 14 years we would have developed full-proof solutions to overcome this challenge but the options like a UPS or generator can get expensive for a small business owner.

In a nutshell load shedding means a loss of income – most merchants and small businesses are not able to accept other forms of payment other than cash if their POS, card or mobile POS (mPOS) machine are down. For those two and half hours (sometimes longer) of scheduled load shedding, small business owners have to find alternative, innovative ways to retain customers and income.

There are a number of reasons why a POS, card and mPOS machine could stop working during load shedding. Without a generator there will be no electricity to power these devices and although most portable card machines have batteries, they don’t last forever and could run out before the power comes back on. Load shedding in your area also means a loss of connectivity to your cellular provider – most card and mPOS machines rely on internet connectivity to function.

While contactless and digital payments are increasingly becoming the preferred method for transacting, it makes it extremely difficult for someone owning a corner store to operate fully during load shedding.

The best way forward for small businesses is to adopt the new technologies and methods that are available to assist with the inconvenience of load shedding.

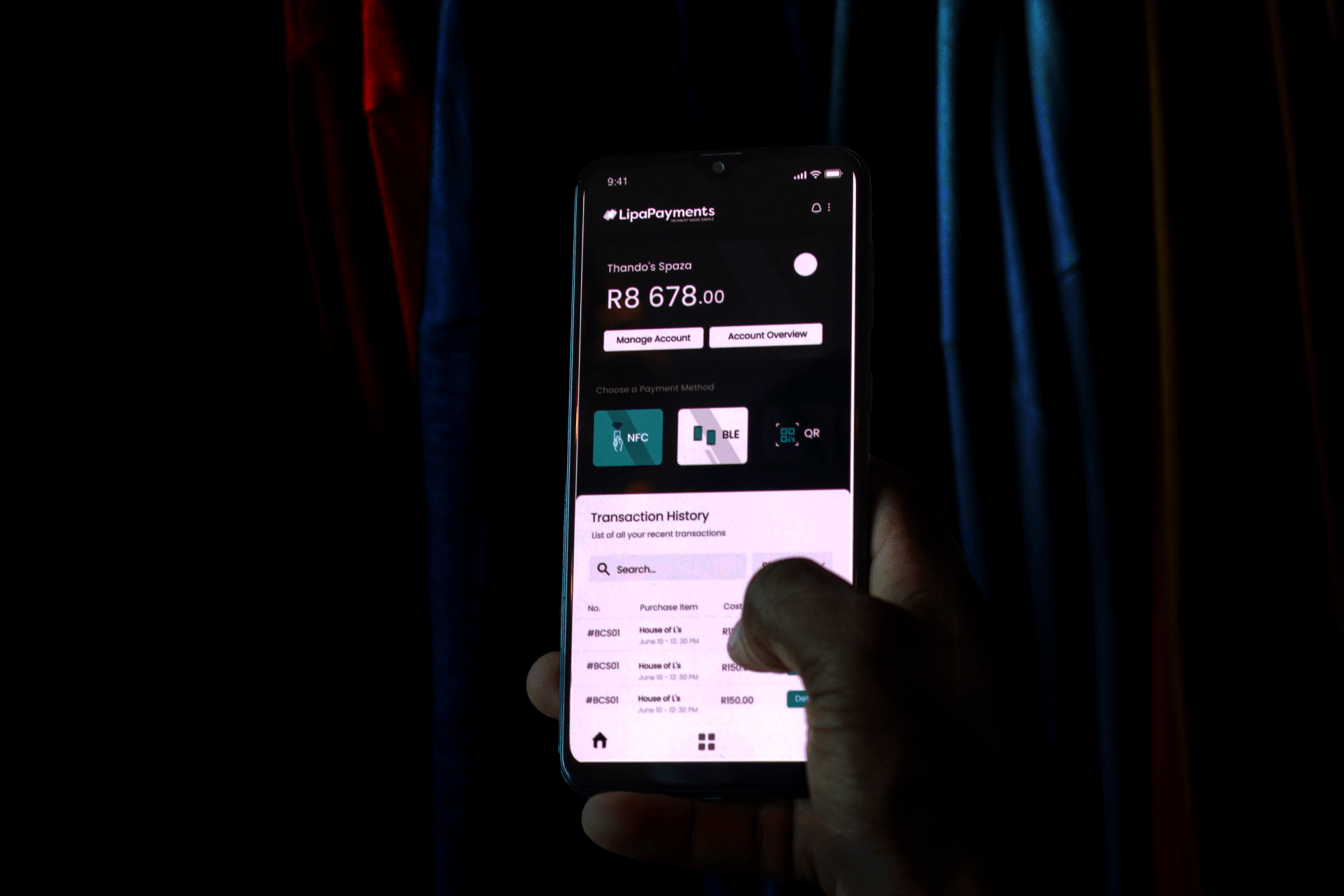

We at Lipa Payments have developed a tap-to-pay, phone-to-phone payment method that uses Bluetooth Low Energy (BLE) called Lipa BLE. Lipa BLE is built to accommodate merchants and consumers that have low-end mobile phones that are Bluetooth enabled but have no NFC, allowing for sales to be concluded anywhere at any time.

Lipa Payments also acknowledges that many parts of Africa experience low internet connectivity and that this could cause problems when making a payment. Lipa BLE allows transactions to be processed even when there is no connectivity, accommodating merchants that are situated in low connectivity areas.

Now whether there is load shedding or poor connectivity, merchants can process transactions seamlessly and never miss out on a sale.

If you want to learn more about Lipa Payments and our products, contact us on hello@lipapayments.com or book a demo.