The technologies driving contactless payments.

Contactless Payments are taking the world by storm.

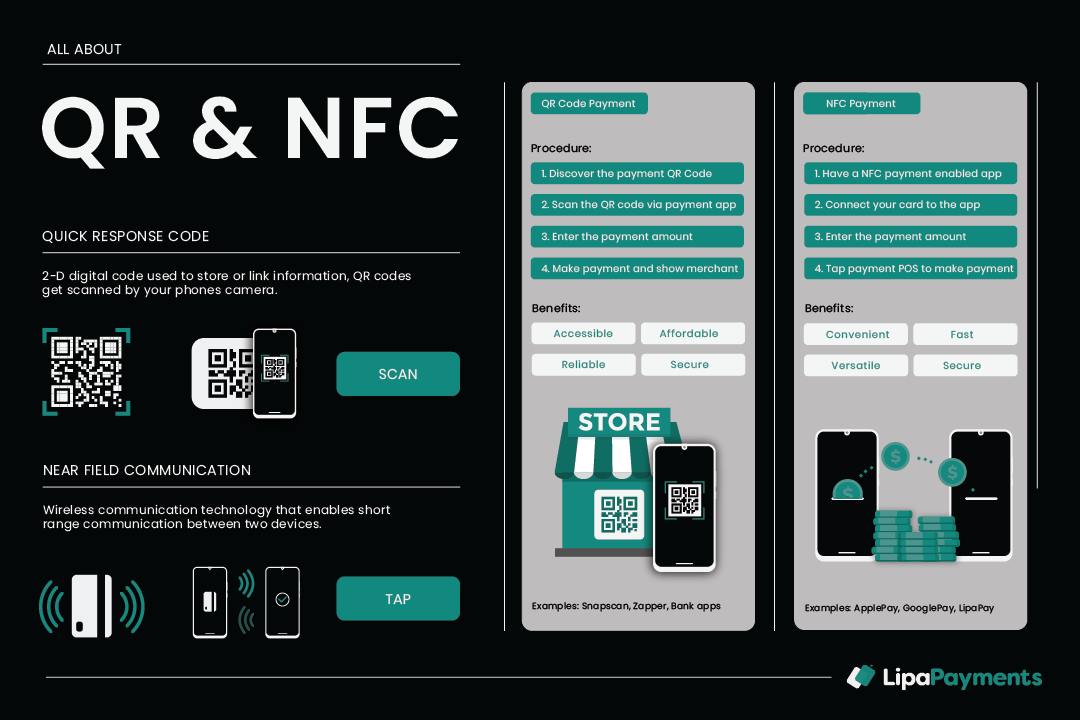

In-person payments have become frictionless thanks to two popular payment technologies, namely Near Field Communication (NFC) and Quick Response codes (QR codes).

The "Tap to Pay"' or "Tap and Go" or "Tap on Phone" solutions in the market today make use of NFC. NFC is a set of protocols for communication between two electronic devices over a short distance and has been around since the early 2000s.

In the early days, the technology did not gain nearly as much popularity as did RFID tags which are commonly used in access control cards. More recently the "Tap and Go" experience that exists in access-control environments has become a popular payment experience in the public transit sector due to the speed and convenience it offers commuters.

The "Scan to Pay" solutions in the market today make use of QR codes. QR Codes are two-dimensional barcodes that represent data in a visual, machine-readable form. QR codes were commonly used to store and read URL addresses before becoming a popular payment experience.

Some banking mobile apps offer both NFC and QR code payment options because each technology comes with its strengths and weaknesses.

One of the benefits of NFC is that consumers can make use of their contactless bank card to pay a merchant which means consumers do not require an “app” or mobile data to make a payment. Another benefit of NFC is that those consumers who forget their wallet and bank card at home can now pay with their smartphone or smart-watch thanks to NFC.

One of the downsides associated with NFC is that NFC penetration rates across rural and township communities is very low. Most low-end and low-cost smartphones do not provide NFC capabilities. Another downside associated with NFC is that countries like Nigeria still have a small number of banks that have moved their customers onto contactless NFC bank cards, making NFC a largely inaccessible technology currently for informal markets in Africa.

Fortunately QR code payments are more accessible as they only require a working camera with basic image focus capabilities. Another benefit of QR code payments is that merchants can print a static QR code and place it near their till, enabling merchants to accept payments whilst offline.

The main downside with QR codes is that it is one-way communication. This means that even when two devices are involved in the QR code payment, the device displaying the QR code can only display information to the scanning device but cannot perform back-and-forth communication which is often used to share the response data for a transaction. This means that a merchant's device does not receive confirmation of the payment unless the merchant has access to an internet connection or the merchant can verify the purchase on the consumer's smartphone whilst being on the opposite side of a store counter.

In the pursuit of a contactless payment experience as great as NFC but as inclusive as QR, we built and patented a solution that can work just like NFC but that is powered by Bluetooth which is a more accessible technology.

Bluetooth dates back to the 90s while Bluetooth Low Energy (BLE) only emerged in 2011 as part of Bluetooth 4.0 to enable very low power applications. Bluetooth was commonly used to transfer files between two devices and is still commonly used in the connection of wireless headphones and wireless speakers.

At Lipa Payments, we believe that Bluetooth Low Energy is the perfect alternative to NFC payments for low-end and low-cost smartphones. We also believe that BLE will enable new payment experiences that NFC cannot offer due to its proximity restriction.

We will discuss more on this topic in our upcoming blog post: "Why Bluetooth Low Energy (BLE)? ". Subscribe to our community newsletter to get updates when we release new blog posts.

If you want to learn more about Lipa Payments and our products, contact us on

hello@lipapayments.com or

book a demo.