How Lipa Payments plans on expanding the world of contactless payments.

According to Visa, in 2020, contactless payments accounted for more than a third of the world’s face-to-face Visa transactions.

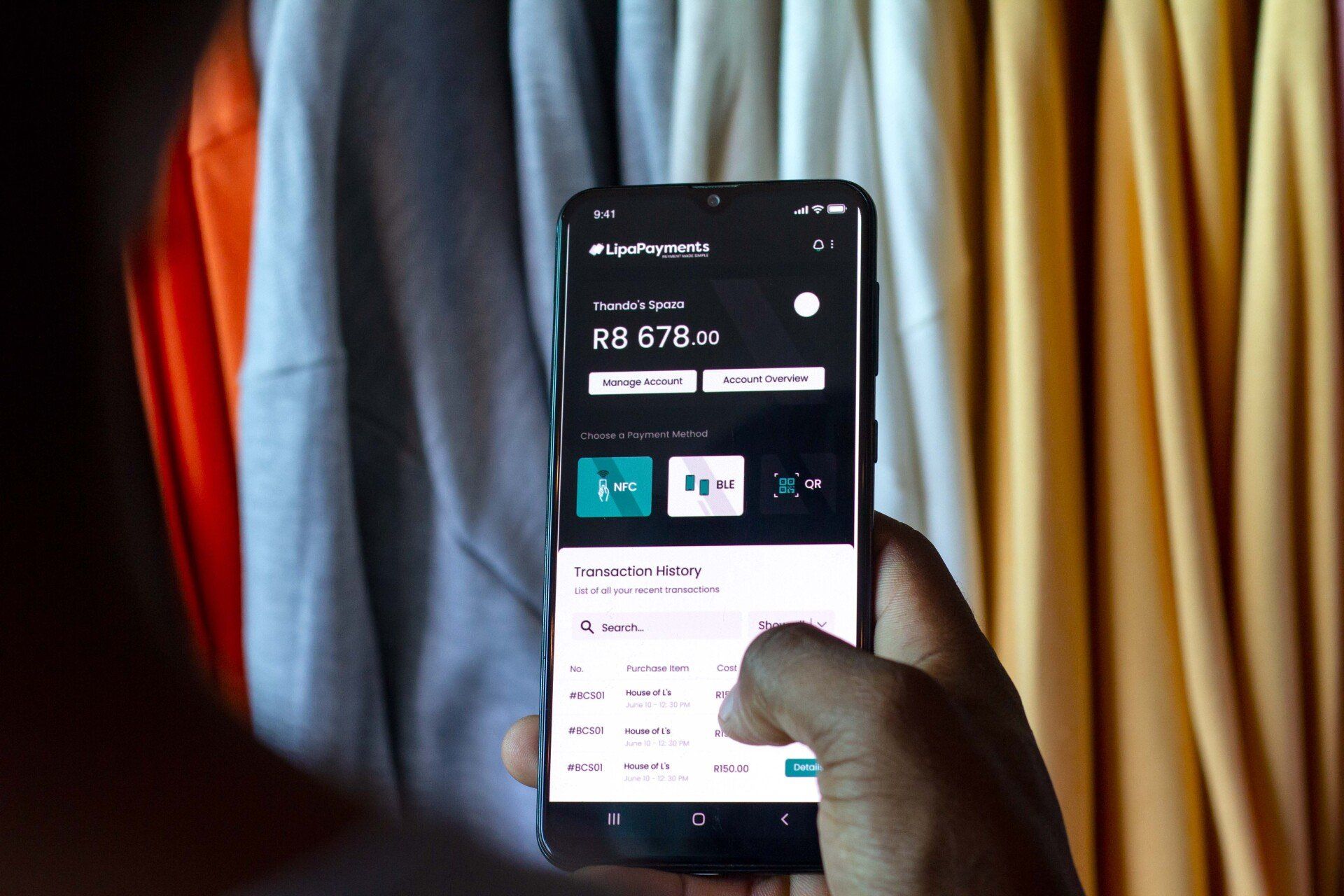

Contactless payments have unlocked new payment experiences for consumers and merchants. Consumers can now pay with their smart-watches, leaving their bank cards at home and merchants can ditch the clunky payment terminal and accept card payments directly from their mobile phone.

We’re excited to introduce Lipa Payments to the world. Lipa Payments builds payment software solutions for banks and fintech's. Banks and fintech’s can integrate our payment software solutions into their existing solutions, to enable secure and accessible and frictionless payment experiences for their merchants and consumers.

Using Near Field Communication (NFC) and Bluetooth Low Energy (BLE) technology we have built payment solutions that allow merchants to accept card payments with no need for additional hardware terminals or attachments.

The questions we at Lipa ask ourselves every single day is, “How can we make digital payments as simple as paying with cash?”

It is a well-known fact that micro-merchants in many parts of Africa transact almost entirely in cash with very few merchants providing digital payment acceptance solutions to their consumers. Lipa’s mission is to help transition Africa away from cash by creating payment solutions that are accessible and simple to use.

Understanding the challenges of internet connectivity in many township and rural areas, Lipa Payments technology has been optimized to work well in low-connectivity environments.

Lastly, understanding the limited penetration of NFC in low-end smartphones, we built and patented a more inclusive alternative, powered by Bluetooth Low Energy which we will discuss in more detail in a future blog.

Lipa Payments was founded in 2019 and is backed by Imvelo Ventures which is a venture capital fund started by Capitec Bank Limited and is managed by Empowerment Capital Investment Partners.

We're excited to make contactless payments simpler and more accessible. Let's get started.

If you want to learn more about Lipa Payments and our products, contact us on hello@lipapayments.com or book a demo.